Digital Assets Weekly Review: Macroeconomic Signals to Observe

Estudios de mercado

As the year progresses, the overall market sentiment has become more negative. Traders are moving their attention from cash flow and credit risks to the wider demand forecast.

Despite a rise in the stock market due to investors' increased risk appetite, several challenges are looming, including banking instability, an oil price spike, and a slowdown in worldwide economic growth.

Investments tied to the physical value of Bitcoin and Ethereum, such as BTCE and ZETH, have proven to be appealing options to diversify investment portfolios. The price of gold in the spot market has surpassed $2,000 again, peaking at $2,041 per ounce at the time of reporting, which is the highest so far this year.

In early May, the US Federal Reserve increased interest rates again, adding 0.25% to their standard rate. This puts the effective federal funds rate between 5% and 5.25%. We anticipate another 0.25% increase before the Federal Reserve reaches its highest possible rate and starts to pause or lower rates in the second half of the year.

The First Republic Bank's collapse is the second largest in US history, only behind the 2008 Washington Mutual failure. J.P. Morgan has agreed with the FDIC to acquire the bank's assets, including $173 billion in loans and $30 billion in securities, as well as $92 billion in customer deposits.

Both the Federal Reserve and President Joe Biden have insisted that the US banking crisis is under control, but it's clear that market concerns continue. The Federal Reserve suggests that interest rates may remain high for an extended period, and the highest projected rate is now 5.5% by June, instead of 5% by May, as we initially thought.

As interest rates increase, the value of bank loans and investment portfolios decreases.

J.P. Morgan has agreed with the Federal Deposit Insurance Company to acquire the bank's assets, including $92 billion in customer deposits and $173 billion in loans. The financial services firm has tried to reassure the markets, stating that the chances of multiple bank failures leading to a 2008-like financial crisis are low.

However, the markets are becoming more apprehensive after similar statements were made following the unexpected collapse of Silicon Valley Bank and Credit Suisse's cash flow crisis in March. The next likely failure could be PacWest Bancorp, a Californian bank, whose shares have fallen by 62% this year, and deposits have dropped nearly 20% in Q1 2023. Institutional investors hold 90.9% of the bank's outstanding shares, one of the highest in any US bank.

There's ongoing anxiety about claiming that the US banking crisis is over. Such declarations can become infamous, especially considering the current global market forecast. As CNBC reported in May 2007, Ben Bernanke, the former Federal Reserve Chair, told Congress that the problems in the subprime sector would be limited and not significantly affect the rest of the economy or the financial system. But shortly after, the world was engulfed in the Great Financial Crisis, and mortgage-backed securities became a nightmare for asset managers and investors.

In the midst of the US banking system chaos, and with three of the four largest bank collapses in US history happening this year, there's the recurring debt ceiling debate in Congress.

Since 1960, Congress has raised the debt ceiling 78 times and increased the spending limit 17 times since Bitcoin was invented in 2008. A US debt default is unlikely due to the enormous impact it would have on the global markets.

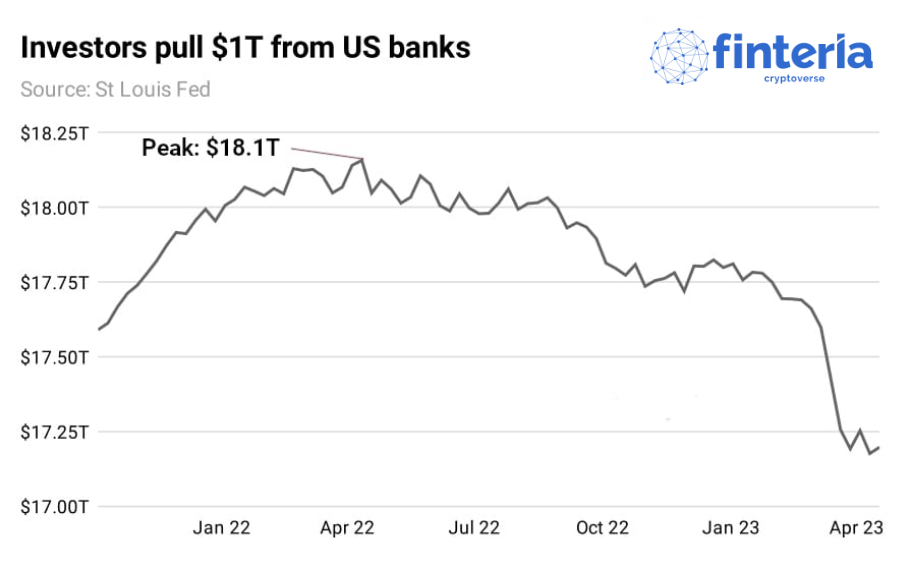

Nonetheless, such turmoil continues to encourage investors to spread their investments into both traditional and unconventional safe havens as protection against disaster. The uncertainty brought by the pandemic led to a significant rise in deposits in 2020 and 2021, peaking at $18.18 trillion. However, money has been leaving commercial banks quickly ever since.

Since the peak in April 2022, investors have withdrawn over $1 trillion from US commercial banks.

Ongoing concerns about US banking have affected the markets, which has been beneficial for Bitcoin, gold, and other safe investments like money market funds (MMFs).

MMFs usually invest in short-term US treasury bills, which currently offer more than a 4% return, while bank accounts are nearly at zero. It's no surprise that customers have been withdrawing large amounts of money from commercial banks. Despite the Federal Reserve increasing interest rates at the fastest speed in 40 years, US banks haven't passed these increases on to their customers. As a result, investors are looking for better returns elsewhere. For instance, savings accounts at Wells Fargo with balances up to $100,000 only offer a 0.25% interest rate.

One alternative for potentially higher returns is the reinvigorated Ethereum, which executed its Shapella hard fork on April 12. This update allows users to withdraw their staked Ethereum from the Beacon Chain. Before Shapella, there were worries that an increase in Ether supply would lead to a significant price drop, but this fear has not come to pass. While more withdrawals than staking deposits occurred in the days following Shapella, the difference was less than what analysts initially thought it might be.